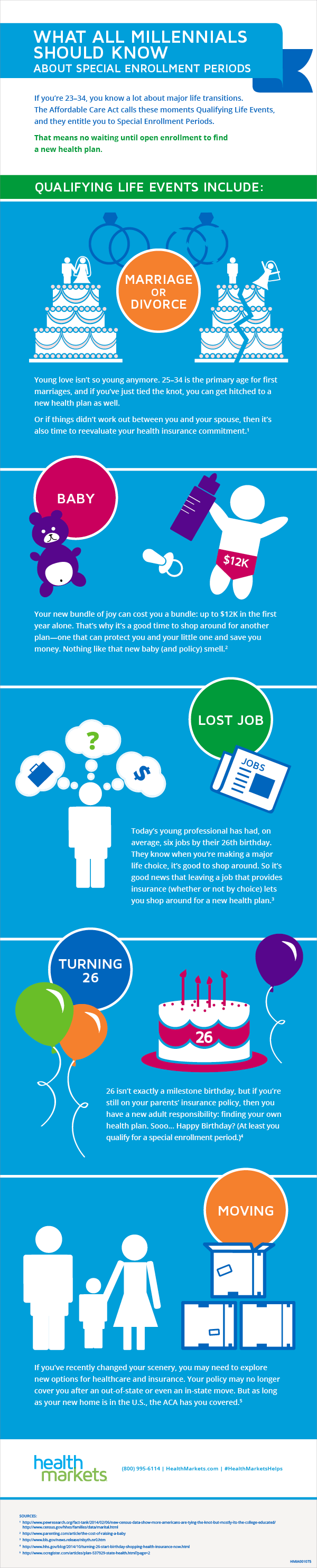

Life throws us curveballs. A new job, marriage, a new baby – these are all exciting milestones, but they can also shake things up, especially when it comes to something as important as health insurance. That's where "qualifying life events" come in. This seemingly complicated term actually unlocks a powerful opportunity to adjust your coverage when you need it most.

Imagine this: you've just landed your dream job, but the health insurance plan offered doesn't quite fit your needs. Or maybe you're welcoming a new member to your family and need to make sure they're covered. In these situations, waiting for the next open enrollment period might not be feasible. That's where understanding "qualifying life events" is crucial.

Many of us associate health insurance changes with a specific time of year – open enrollment. It's that annual window where we can tweak our plans, add dependents, or explore different options. But what happens when life throws you an unexpected change outside of that timeframe?

A "qualifying life event" acts as a trigger, a specific circumstance recognized by health insurance providers (and often employers) that allows you to make changes to your coverage outside of the typical open enrollment period. Think of it as a safety net, ensuring you're not left without adequate coverage when significant changes impact your life.

But here's the thing: not every life event qualifies. And navigating the world of insurance jargon can feel overwhelming. So, let's break down what exactly constitutes a qualifying life event, why it matters, and how understanding this concept can empower you to make informed decisions about your health coverage.

Advantages and Disadvantages of Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage outside of open enrollment | Limited time frame to make changes |

| Ensures you have appropriate coverage during major life transitions | Potential for confusion regarding eligible events |

Best Practices for Utilizing Qualifying Life Events

1. Know Your Qualifying Events: Familiarize yourself with the common qualifying life events recognized by your insurance provider or employer. This proactive step saves you time and potential headaches down the road.

2. Gather Documentation: Insurance providers often require documentation to verify the qualifying event. Keep important documents readily accessible – marriage certificates, birth certificates, or termination notices can streamline the process.

3. Act Promptly: Time is of the essence when utilizing a qualifying life event. There's a limited window to make changes to your coverage, often 30 or 60 days from the event.

4. Compare Plans Carefully: Take the time to thoroughly evaluate different insurance plans and their coverage options. This ensures you select the most suitable plan for your new circumstances.

5. Seek Assistance: Don't hesitate to reach out to your insurance provider or employer's HR department for clarification or guidance throughout the process. They can provide valuable support and address any questions you may have.

Common Questions and Answers About Qualifying Life Events

1. What are some examples of qualifying life events?

Common examples include marriage, divorce, birth of a child, adoption, loss of other health coverage (like losing a job), and relocation to a new geographic area. The specifics might vary based on your insurance provider and location.

2. How long do I have to make changes to my health insurance after a qualifying life event?

Typically, you'll have 30 or 60 days from the date of the qualifying event. It's crucial to act promptly, as missing this window could mean waiting until the next open enrollment period.

3. What documents do I need to provide to prove a qualifying life event?

The required documentation varies depending on the specific event. Be prepared to provide documents like marriage certificates, birth or adoption papers, divorce decrees, termination notices from a previous employer, or proof of new residence.

4. Can I change my health insurance plan if I move to a new state?

Yes, relocating to a new state is generally considered a qualifying life event. You'll need to explore health insurance options available in your new state and select a plan that meets your needs.

5. What happens if I don't experience a qualifying life event but need to change my health insurance?

In most cases, you'll have to wait until the next open enrollment period to make changes to your health insurance plan. It's essential to carefully review your plan during open enrollment and select coverage that aligns with your anticipated needs for the upcoming year.

6. Can I add a new spouse or child to my health insurance plan outside of open enrollment?

Yes, both marriage and the birth or adoption of a child are considered qualifying life events, allowing you to add your new spouse or child to your plan.

7. What if I lose my job-based health insurance?

Losing job-based coverage is a qualifying life event. You'll have options like enrolling in COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation coverage or exploring plans through the Health Insurance Marketplace.

8. Where can I find more information about qualifying life events?

For detailed information, refer to your health insurance policy documents, contact your insurance provider directly, or reach out to your employer's HR department.

Tips and Tricks for Navigating Qualifying Life Events

* Keep yourself informed: Periodically review the list of qualifying life events outlined by your insurance provider, as they can change.

* Stay organized: Maintain a file or digital folder with important insurance documents for easy access when needed.

* Don't hesitate to ask for help: Insurance representatives and HR professionals are valuable resources, so don't shy away from seeking their guidance.

Understanding "qualifying life events" empowers you to take control of your health insurance coverage during significant life transitions. While navigating the complexities of insurance can seem daunting, remember that knowledge is power. By familiarizing yourself with the concept of qualifying life events, you're better equipped to adapt your coverage as your life evolves, ensuring you and your loved ones have the support you need, when you need it most.

The mr wong effect when a restaurant becomes a sydney institution

Snake tattoos that wrap around your forearm a sinuous trend

Heart tattoos with flowers a blooming love story on skin

How Do Qualifying Life Events Work? - You're The Only One I've Told

Due to qualifying life events, Federal Employees Health Benefits can - You're The Only One I've Told

Qualifying Life Event (QLE) - You're The Only One I've Told

Updating your benefits through a qualifying status change (life event) - You're The Only One I've Told

Qualifying Life Events: Everything you need to know about Obamacare in - You're The Only One I've Told

define qualifying life event - You're The Only One I've Told

The Amazing Truth About Qualifying Life Events for Millennials - You're The Only One I've Told

Qualifying Life Events and the Impact on Health Insurance - You're The Only One I've Told

Can I Sign Up For Health Insurance After Open Enrollment? - You're The Only One I've Told

What Is a Qualifying Life Event? - You're The Only One I've Told

What Is A Qualifying Life Event? - You're The Only One I've Told

What Employers Need to Know About a Qualifying Life Event - You're The Only One I've Told

define qualifying life event - You're The Only One I've Told

What is a qualifying life event for health insurance? - You're The Only One I've Told

Fillable Online Proof of qualifying life event form Fax Email Print - You're The Only One I've Told

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)