Life has a funny way of throwing curveballs when you least expect it. One minute you’re picking out throw pillows, the next you’re Googling “can babies tell if you ate too much garlic?” (Spoiler alert: the jury’s still out on that one). But amidst the whirlwind of baby prep and existential food questions, there's serious stuff to consider, like health insurance.

That’s where the phrase “qualifying life event” enters the chat. It might sound like corporate jargon, but understanding this term can be a game-changer, especially when you’re expecting a little one. Buckle up, because we're about to dive deep into the world of qualifying life events and why pregnancy is a big deal in this arena.

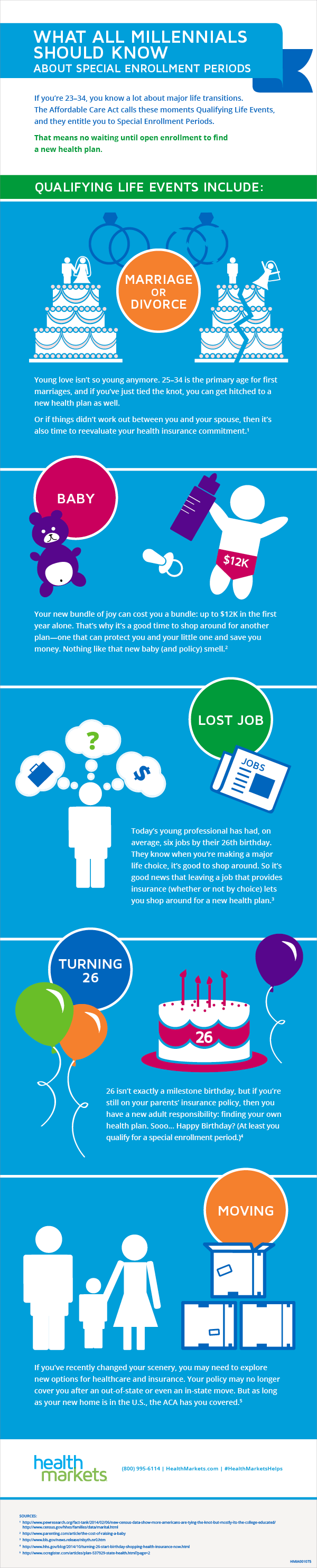

Imagine this: You've carefully picked your health insurance plan. You know, the one that seemed perfect for your lifestyle at the time (pre-baby brain fog). Then, bam! Life throws you a curveball in the form of a positive pregnancy test. This is where “qualifying life events” (QLEs) come in. These are major life changes – like getting married, having a baby, or moving – that allow you to make changes to your health insurance outside the usual enrollment period.

Why does this matter? Well, having a baby means doctor’s appointments, ultrasounds, maybe even a hospital stay or two. All of these things can get expensive, fast. A qualifying life event like pregnancy can be your ticket to reassessing your health insurance needs. Maybe you need a plan with better maternity coverage, or perhaps you need to add your new little one as a dependent.

Knowing your rights and options regarding QLEs is like having a secret weapon in the world of adulting. It can be the difference between feeling financially prepared and feeling like you’re drowning in medical bills. Plus, understanding these things empowers you to make the best choices for yourself and your growing family.

Advantages and Disadvantages of Pregnancy as a Qualifying Life Event

Let's take a closer look at the upsides and downsides, presented in a way that even someone knee-deep in baby name books can understand:

| Advantages | Disadvantages |

|---|---|

| Flexibility to change your health plan: You're not stuck with a plan that no longer fits your needs. | Time sensitivity: You usually have a limited window (often 60 days) to make changes after the qualifying event. |

| Opportunity to get better coverage: You can potentially find a plan with lower out-of-pocket costs for pregnancy and childbirth. | Potential paperwork: Be prepared to gather documentation, like a birth certificate, to prove the qualifying event. |

| Peace of mind: Knowing you have the right coverage can ease some of the stress that comes with a new baby. |

Eight Common Questions (and Answers!) About Pregnancy and Health Insurance

Let's tackle some frequently asked questions about this whole qualifying life event thing, because let's be real, Googling at 3 AM while your partner snores peacefully is nobody's idea of fun.

1. I'm pregnant! When can I change my health insurance plan?

Congratulations! In most cases, you'll have a 60-day window after your baby's birth (or adoption) to make changes to your health plan. However, it's always best to double-check with your insurance provider to confirm their specific rules and deadlines.

2. What kind of documentation do I need to prove my qualifying life event?

Typically, you'll need to provide proof of the event. This could be a birth certificate, adoption papers, or official documentation related to your change in circumstances. Your insurance company will give you specific instructions.

3. Can I add my newborn to my current health plan?

Absolutely! Your newborn is usually eligible for coverage under your plan, even if they're born outside the open enrollment period. Again, those magical QLEs come to the rescue! You'll generally have a limited time to enroll them, so act swiftly.

4. My partner and I are both insured. Can we keep our babies on both plans?

You'll want to chat with your insurance providers about something called "coordination of benefits." This helps determine which plan is primary and which is secondary if you have coverage under both. It prevents duplicate payments and helps maximize your benefits.

5. I'm having a baby soon, but open enrollment is coming up anyway. Should I wait?

This is a bit of a personal decision, and it depends on your individual circumstances. Talk to your insurance agent or a benefits counselor. They can help you weigh the pros and cons of switching now versus waiting for open enrollment based on your specific plan and needs.

6. What if my employer doesn't offer health insurance, or I'm self-employed?

You still have options! You might be eligible to purchase coverage through the Health Insurance Marketplace. Pregnancy is considered a qualifying life event for special enrollment through the Marketplace as well.

7. I'm stressed about the cost of prenatal care and childbirth. Are there any resources that can help?

Your doctor or hospital's billing department might be able to provide information about payment plans or financial assistance programs. You can also contact your local social services agency or search online for resources specific to your state.

8. This is all so confusing! Is there someone who can help me figure out my options?

Don't worry, you're not alone! Navigating the world of health insurance can feel like learning a new language. Many resources are available to help. You can start by contacting your insurance company directly. They often have customer service representatives who can answer your questions and guide you through the process.

Conclusion: Your Health, Your Choices

Navigating the world of health insurance while pregnant might seem as daunting as assembling a crib at 2 AM, but armed with the knowledge that pregnancy is a qualifying life event, you can confidently tackle this aspect of impending parenthood. Remember, understanding your options empowers you to make the best choices for yourself and your growing family. So, take a deep breath, celebrate this exciting new chapter, and know that you've got this!

Dreaming of ecuador find your perfect pasajes aereos economicos

Spice up your ride exploring the latest rav4 color palette

The force of fandom exploring reys impact in star wars

Updating your benefits through a qualifying status change (life event) - You're The Only One I've Told

Qualifying Life Events and the Impact on Health Insurance - You're The Only One I've Told

What is a qualifying life event for health insurance? - You're The Only One I've Told

is being pregnant a qualifying life event - You're The Only One I've Told

Moving is a qualifying life event that allows you to get health - You're The Only One I've Told

Hanford Mission Integration Solutions - You're The Only One I've Told

The Amazing Truth About Qualifying Life Events for Millennials - You're The Only One I've Told

Fillable Online Proof of qualifying life event form Fax Email Print - You're The Only One I've Told

is being pregnant a qualifying life event - You're The Only One I've Told

Qualifying Life Event (QLE) - You're The Only One I've Told

is being pregnant a qualifying life event - You're The Only One I've Told

Understanding Qualifying Life Events (QLEs) - You're The Only One I've Told

Qualifying Life Events for Insurance: 2024 Guide - You're The Only One I've Told

Understanding The Special COVID - You're The Only One I've Told

Qualifying Life Events for Insurance (2023) - You're The Only One I've Told