Imagine a world where you could easily unlock the secrets of your income tax status with a few clicks. No more anxious waiting, no more frantic calls to tax offices. Sounds too good to be true? Well, in the digital age, this is becoming a reality for many, thanks to the power of "cara semak cukai pendapatan."

Now, before you dismiss this as just another technical jargon, let's break it down. "Cara semak cukai pendapatan" simply translates to "how to check income tax" in Malay. It's the key to taking control of your tax obligations and ensuring everything is in order.

Think of it like this: your income tax is like a financial puzzle, and "cara semak cukai pendapatan" provides you with all the pieces and guidance to put it together correctly. It's about empowering yourself with knowledge and tools to navigate the often-confusing world of taxes.

But why should you care? In a nutshell, "cara semak cukai pendapatan" can save you from potential headaches down the road. It helps you avoid penalties, ensures you're not overpaying, and gives you a clear picture of your financial standing.

Whether you're a seasoned taxpayer or just starting out, understanding "cara semak cukai pendapatan" is essential. It's not just about fulfilling an obligation; it's about taking charge of your financial well-being and making informed decisions about your money. So, let's dive deeper into this world and explore how you can benefit from it.

Advantages and Disadvantages of "Cara Semak Cukai Pendapatan"

| Advantages | Disadvantages |

|---|---|

| Convenience and time-saving | Potential technical issues or website downtime |

| Transparency and accuracy | Requires internet access and digital literacy |

| Empowerment and control over tax information | Possible security risks if not accessing secure platforms |

Best Practices for "Cara Semak Cukai Pendapatan"

1. Choose Secure and Official Platforms: Always opt for the official government tax portal or reputable websites to avoid scams or misinformation.

2. Keep Your Tax Information Handy: Have your tax identification number, previous assessment details, and any relevant financial documents readily available.

3. Double-Check All Information: Before submitting any information, ensure its accuracy to prevent discrepancies or delays in processing.

4. Regularly Check for Updates: Tax regulations and systems can change, so stay informed about any updates or announcements from the tax authorities.

5. Seek Professional Help When Needed: If you encounter complex situations or have doubts, don't hesitate to consult a qualified tax professional for guidance.

Common Questions and Answers about "Cara Semak Cukai Pendapatan"

1. What is "cara semak cukai pendapatan"? It refers to the process of checking your income tax status in Malaysia.

2. Why is it important to check my income tax status? It ensures you're compliant with tax laws, helps you avoid penalties, and allows you to claim any refunds you might be eligible for.

3. How often should I check my income tax status? It's recommended to check it at least annually, especially after filing your tax returns or if there are any changes in your income or employment.

4. What do I need to check my income tax status online? You'll typically need your tax identification number, password, and sometimes a security code sent to your registered phone number or email address.

5. What if I find an error in my income tax status? Contact the tax authorities immediately and provide supporting documents to rectify the issue.

6. Can I check someone else's income tax status for them? No, it's illegal to access or attempt to access someone else's tax information without their explicit consent.

7. Is there a fee to check my income tax status? No, most tax authorities provide this service free of charge through their official portals.

8. Can I get assistance with "cara semak cukai pendapatan" if I'm not tech-savvy? Yes, tax offices often offer in-person assistance or you can seek help from a tax professional.

Tips and Tricks for "Cara Semak Cukai Pendapatan"

* Bookmark the official tax portal for quick access.

* Set reminders on your phone or calendar to check your tax status regularly.

* Utilize the online chat support or FAQs available on tax websites for quick answers.

* Keep digital copies of all your tax-related documents for easy reference.

In conclusion, embracing "cara semak cukai pendapatan" is no longer just a chore but an essential part of personal financial management. By understanding the process, utilizing the available tools, and staying informed, you can navigate the world of taxes with confidence and peace of mind. Remember, knowledge is power, and when it comes to your finances, taking charge is always the smartest move.

Happy belated birthday meme funny for her

Unveiling the evil eye protection symbol meaning history and benefits

Meh aningful musings exploring the meh ridian of language

cara semak cukai pendapatan - You're The Only One I've Told

Cara Semak Cukai Tanah & Bayar Online Setiap Negeri, Tak Perlu Beratur - You're The Only One I've Told

Cara Semak No Cukai Pendapatan LHDN Number - You're The Only One I've Told

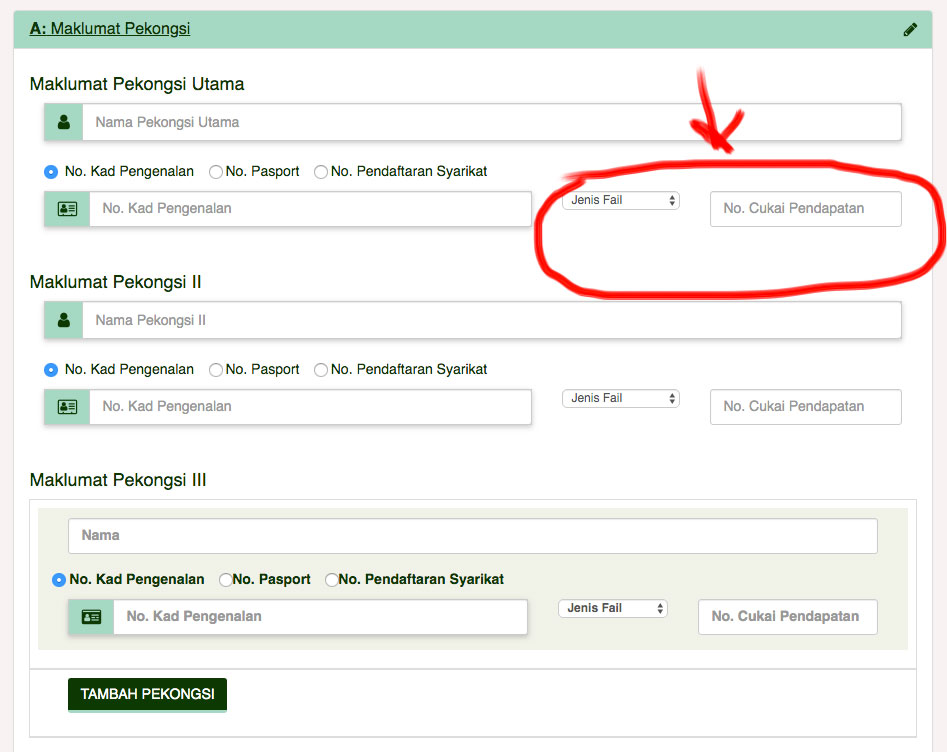

Cara Isi Borang E - You're The Only One I've Told

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti - You're The Only One I've Told

CARA MENDAPATKAN NO CUKAI PENDAPATAN INDIVIDU DAN SYARIKAT SERTA DAFTAR - You're The Only One I've Told

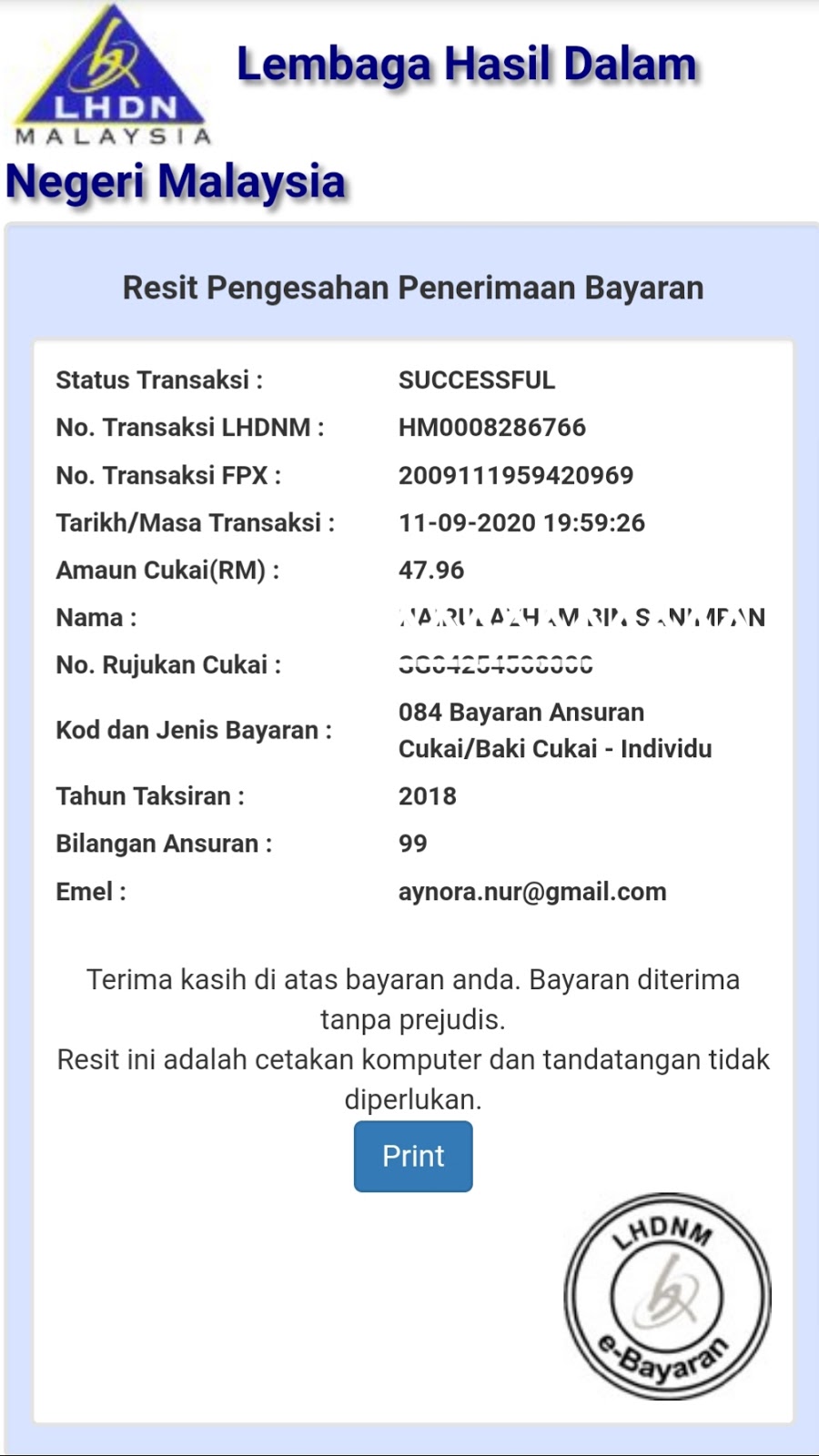

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - You're The Only One I've Told

Semakan Slip Gaji Online di e - You're The Only One I've Told

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU - You're The Only One I've Told

Cara Bayar Semak Cukai Tanah Johor Secara Online - You're The Only One I've Told

Cukai Pendapatan Individu & Cara Bayar Online - You're The Only One I've Told

Cukai Pintu Selangor:Permohonan dan Cara Semak - You're The Only One I've Told

Semak No Cukai Pendapatan Pekerja - You're The Only One I've Told

Cara Daftar dan Semak MyJPJ - You're The Only One I've Told

Cara Semak Cukai Tanah & Bayar Online Setiap Negeri, Tak Perlu Beratur - You're The Only One I've Told