In the tapestry of modern life, where interconnectedness reigns supreme, the smooth transfer of funds forms the very threads that bind our financial well-being. We seek channels that are not just efficient, but also imbued with a sense of trust and security. Enter, the realm of bank wire transfers – a realm often perceived as complex, yet brimming with potential for those seeking swift and secure financial transactions.

Imagine, if you will, the ability to move substantial sums across borders, to settle urgent payments with a few keystrokes, or to simply ensure that your loved ones, near or far, receive financial support precisely when they need it most. This, my friends, is the allure of the bank wire transfer. And when it comes to navigating this landscape with confidence, Wells Fargo Bank stands as a beacon of reliability.

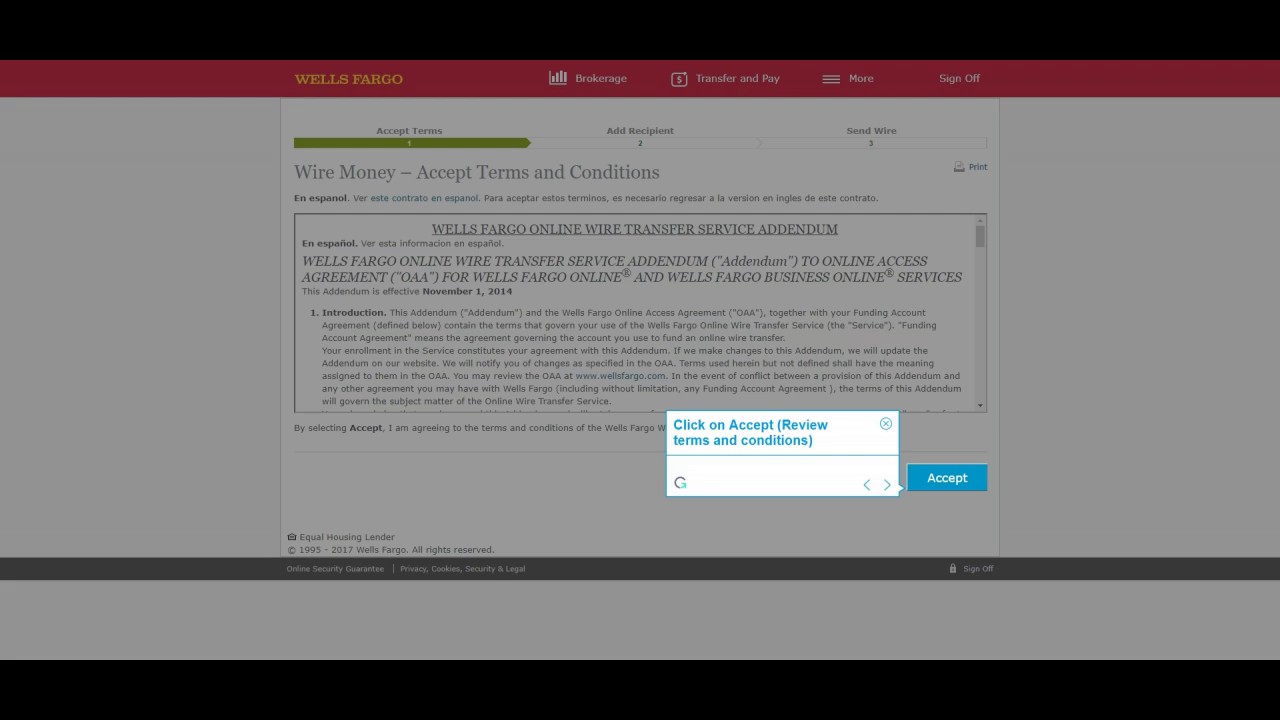

But let's be real, the intricacies of Wells Fargo bank wire instructions can feel like deciphering ancient runes. Fear not, for we're about to embark on a journey to demystify this process, empowering you to navigate the world of wire transfers with the grace of a seasoned financier.

We'll delve into the nuances of SWIFT codes, unravel the mysteries of intermediary banks, and shed light on the importance of accuracy when it comes to account numbers and routing numbers. Think of this as your comprehensive guide to understanding the language of Wells Fargo bank wire instructions.

Whether you're a seasoned entrepreneur navigating international transactions or an individual seeking to support loved ones abroad, understanding the nuances of Wells Fargo bank wire instructions can unlock a world of financial empowerment. So, grab your metaphorical compass, and let's embark on this enlightening expedition together.

Advantages and Disadvantages of Wells Fargo Bank Wire Instructions

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency of transactions | Potential for fees, both from Wells Fargo and intermediary banks |

| High level of security for large sums | Irreversible nature of wire transfers, requiring meticulous accuracy |

| Global reach, facilitating international transactions | Limited recourse in case of errors or fraudulent activity |

Just like choosing the perfect crystal to amplify your intentions, selecting the right financial tool requires careful consideration. Wire transfers, while powerful, come with their own set of nuances. Understanding both the advantages and disadvantages empowers you to make informed decisions aligned with your financial goals.

As you embark on your financial wellness journey, remember that knowledge is power. By embracing the insights shared here, you're one step closer to navigating the world of Wells Fargo bank wire instructions with confidence and clarity.

Navigating the virginia state employee work schedule

The impact of short form video navigating the tiktok phenomenon

The subtle roar navigating air conditioner outdoor unit sounds

Bank Of America Wiring Transfer - You're The Only One I've Told

wire transfer instructions for wells fargo bank - You're The Only One I've Told

Td Bank Us Wire Instructions - You're The Only One I've Told

Wells Fargo Check Verification 2020 - You're The Only One I've Told

Wells fargo wire transfer form pdf: Fill out & sign online - You're The Only One I've Told

Wire Transfer Receipt Wells Fargo - You're The Only One I've Told

Proof Of Funds Letter - You're The Only One I've Told

wells fargo bank wire instructions - You're The Only One I've Told

Wells Fargo Letter Of Authorization 2020 - You're The Only One I've Told

Wells Fargo Wire Transfer Fees and Instructions - You're The Only One I've Told

Online Wire Limit Wells Fargo at Rodney Maddux blog - You're The Only One I've Told

Bank Of America International Wiring Fee - You're The Only One I've Told

Wells Fargo SWIFT/BIC Code is WFBIUS6S - You're The Only One I've Told

wells fargo bank wire instructions - You're The Only One I've Told

Wells Fargo Bank Wire - You're The Only One I've Told