Imagine this: you've worked hard all year, achieved your career goals, and are enjoying the fruits of your labor. But amidst the excitement, there's a sense of responsibility, a desire to share your blessings and make a difference. In Islam, this sense of responsibility is beautifully embodied in the concept of Zakat, a pillar that not only purifies your wealth but also uplifts the lives of those in need.

Zakat, often translated as "alms-giving" or "purification," is one of the five pillars of Islam and a fundamental act of worship for Muslims. It's not just about giving; it's about fostering a just and equitable society where everyone has the opportunity to thrive. While Zakat encompasses various categories, today, we'll delve into "Zakat Pendapatan" - Zakat on income, a topic particularly relevant to those residing in Selangor, Malaysia.

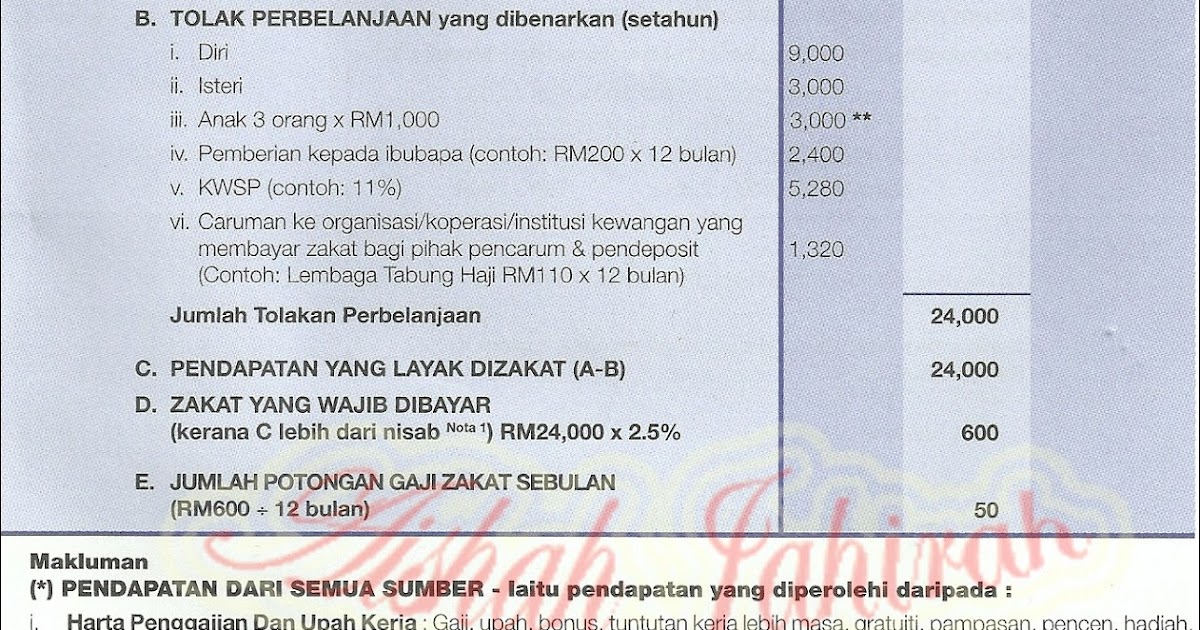

In the heart of Malaysia, Selangor stands as a testament to progress and modernity, yet deeply rooted in its Islamic heritage. Navigating the financial landscape in a place like Selangor can be exhilarating, but it's equally important to remain grounded in our faith and understand our obligations. "Cara kira zakat pendapatan Selangor" - the method of calculating Zakat on income in Selangor - might sound like a mouthful, but fear not! It's a straightforward process that becomes clearer with understanding.

This comprehensive guide aims to demystify "cara kira zakat pendapatan Selangor," providing you with the knowledge and tools to fulfill this crucial Islamic duty. We'll explore its origins, significance, and how it directly impacts the lives of the less fortunate within the Selangor community. Think of this as your one-stop resource for understanding and calculating your Zakat on income, empowering you to embrace this act of worship with confidence and clarity.

Now, whether you're a seasoned professional, a young entrepreneur, or new to the workforce in Selangor, understanding your Zakat obligation is a significant step towards fulfilling your spiritual duty and contributing to a more compassionate and just society. Let's embark on this journey of understanding and unlock the blessings that come with fulfilling this vital pillar of Islam.

Advantages and Disadvantages of Understanding Zakat Pendapatan

While the concept of Zakat is rooted in spiritual obligation, understanding the practical aspects, especially "cara kira zakat pendapatan Selangor," has tangible benefits. Let's weigh the advantages and potential challenges:

| Advantages | Potential Challenges |

|---|---|

|

|

Best Practices for Fulfilling Your Zakat Pendapatan Obligations

Here are some practical tips to make your Zakat payment process smoother:

- Maintain Detailed Financial Records: Keep track of your income, expenses, and eligible deductions throughout the year. This makes calculating your Zakat much easier.

- Refer to Official Sources: Consult the official website of Lembaga Zakat Selangor (LZS) or contact their representatives for the most up-to-date information on nisab values, payment methods, and FAQs.

- Utilize Online Calculators and Resources: LZS and other reputable Islamic financial institutions offer online calculators and resources to help you determine your Zakat amount accurately.

- Set Reminders for Zakat Payment: Mark your calendar or set reminders to ensure timely payment of your Zakat, especially during Ramadan when many Muslims prefer to fulfill this obligation.

- Educate Yourself and Your Family: Learn about the different categories of Zakat and discuss their importance with your family. Instill the value of giving and fulfilling Islamic obligations from a young age.

Common Questions about Zakat Pendapatan in Selangor

Let's address some frequently asked questions:

- Q: What is the nisab for Zakat on income in Selangor?

A: The nisab for Zakat on income can vary annually. It's best to check with LZS for the most up-to-date information. - Q: Can I deduct my monthly expenses before calculating Zakat?

A: No, Zakat is calculated on your gross income after deducting specific allowances permitted under Islamic law. - Q: What are the different ways I can pay my Zakat in Selangor?

A: LZS offers various payment channels, including online payments, bank transfers, salary deductions, and cash payments at their offices or authorized collection centers. - Q: Is my Zakat payment tax-deductible?

A: Yes, Zakat payments made to LZS are eligible for tax deductions in Malaysia. - Q: What happens if I don't pay Zakat?

A: Fulfilling Zakat is considered an Islamic obligation. Not paying Zakat when you are financially able to do so can have spiritual consequences. - Q: I'm a foreigner working in Selangor. Do I need to pay Zakat?

A: If you are Muslim and your income meets the nisab requirements, then yes, you are obligated to pay Zakat. - Q: Can I choose where my Zakat goes?

A: While it's generally advisable to pay Zakat through official channels like LZS, you can also distribute it directly to eligible recipients as long as they meet the criteria outlined in Islamic law. - Q: Where can I find more information about Zakat in Selangor?

A: Visit the official website of Lembaga Zakat Selangor (LZS) or contact their customer service for detailed information and assistance.

Conclusion

Navigating the intricacies of "cara kira zakat pendapatan Selangor" might seem daunting at first, but it's a journey well worth taking. Remember, Zakat is not merely a financial transaction; it's an act of worship, a testament to our faith, and a commitment to social responsibility. By understanding our obligations and fulfilling them with sincerity, we not only purify our wealth but also contribute to a more just and compassionate society. Embrace the spirit of giving, seek knowledge, and fulfill your Zakat obligations with a grateful heart. Your contributions, however small or large, can make a world of difference in the lives of those in need.

Aging with grace the ultimate guide to style for men over 60

Two sigma freshman internship application

The unmasking of kane why wwe took the big red machines mask off

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

Rupanya Ada 2 Cara Kira Zakat Pendapatan - You're The Only One I've Told

Panduan Lengkap Zakat Pendapatan di Malaysia 2024 - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

cara kira zakat pendapatan selangor - You're The Only One I've Told

Cara Kira Zakat Peniaga Online / Dropship, Jika Cukup Syarat - You're The Only One I've Told

Panduan Kira Zakat Perniagaan Dengan Mudah - You're The Only One I've Told

Cara Kira Zakat Pendapatan - You're The Only One I've Told

Jangan Lupa Bayar Zakat Pendapatan Tahun 2020. Ini Cara Kiraannya Yang - You're The Only One I've Told