In the heart of Malaysia's most developed state, Selangor, lies a deeply rooted tradition of Islamic finance, with Zakat playing a pivotal role. Zakat, one of the five pillars of Islam, is a mandatory form of almsgiving for eligible Muslims. It serves as a system of wealth distribution and purification, ensuring social welfare and economic balance. This article aims to shed light on the method of calculating Zakat on income in Selangor (commonly known as "cara pengiraan zakat pendapatan Selangor" in Malay), providing clarity and guidance for those seeking to fulfill this significant religious obligation.

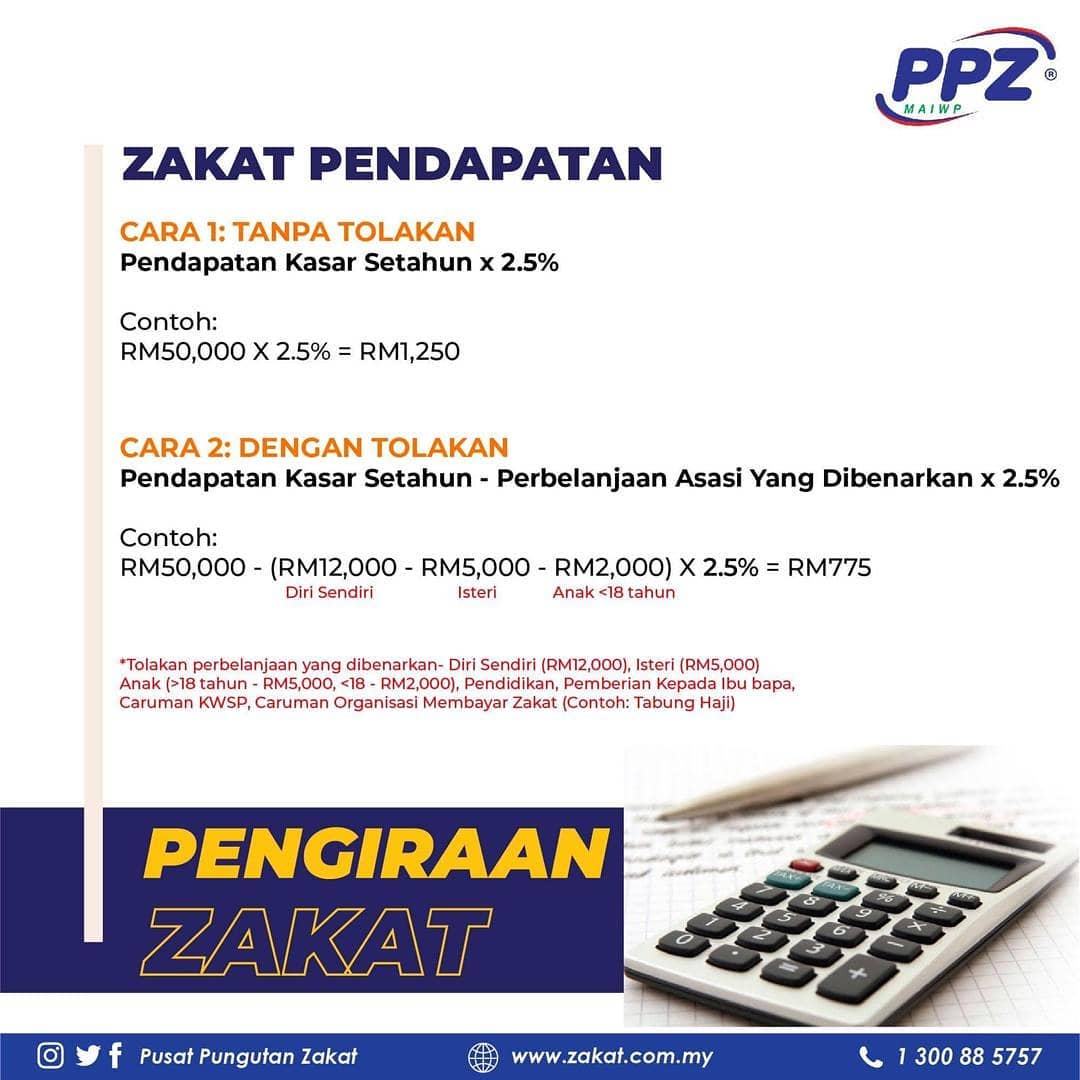

Zakat on income, as the name suggests, is calculated based on an individual's earnings. This includes salaries, wages, business profits, rental income, and any other halal sources of revenue. Understanding the "cara pengiraan zakat pendapatan Selangor," or the calculation method, is essential for Muslims residing or earning income in Selangor. The Lembaga Zakat Selangor (LZS), the religious body responsible for Zakat administration in the state, provides clear guidelines and resources to facilitate this process.

The concept of Zakat is deeply rooted in the Quran and the teachings of Prophet Muhammad (PBUH). It is a testament to the social consciousness and compassion embedded within the principles of Islam. Zakat serves as a bridge between the affluent and the less fortunate, promoting a just and equitable society.

Calculating Zakat accurately is crucial to fulfilling this religious duty. The process involves determining if one has reached the Nisab, the minimum threshold of wealth above which Zakat becomes obligatory. In the case of Zakat on income, the Nisab is determined based on the current market value of gold or silver. The LZS website provides up-to-date information on the Nisab value.

Beyond its spiritual significance, Zakat plays a crucial role in fostering economic empowerment and community development. Funds collected through Zakat are distributed among eight categories of recipients (asnaf) outlined in the Quran. These include the poor, the needy, debtors, travelers in need, and others who require assistance. This ensures that Zakat contributions directly benefit those who need it most, creating a safety net for the vulnerable and fostering a culture of support within society.

Advantages and Disadvantages of Zakat

While there are no disadvantages to fulfilling a religious obligation like Zakat, understanding its impact can offer a broader perspective:

| Advantages | Considerations |

|---|---|

| Purification of wealth | Requires accurate calculation and understanding of regulations |

| Social welfare and poverty alleviation | Individual responsibility to fulfill the obligation |

| Economic empowerment and circulation of wealth | Reliance on individual compliance and honesty in declaration of income |

Navigating the "cara pengiraan zakat pendapatan Selangor" might seem daunting initially, but the LZS has simplified the process, offering various resources like online calculators and comprehensive guides on their website. Understanding the importance of Zakat and its calculation empowers individuals to fulfill this significant pillar of Islam. By embracing the spirit of Zakat, we contribute to a more just and compassionate society, upholding the values of Islam and fostering collective well-being.

Catch wwe raw live your guide to tonights action

Level up your gameplay the best songs for fortnite

Georgias garden symphony a guide to seed starting times

Kaedah Kiraan, Cara Bayar Zakat Simpanan di Malaysia 2024 - You're The Only One I've Told

Cara Kira Zakat Peniaga Online / Dropship, Jika Cukup Syarat - You're The Only One I've Told

Contoh Pengiraan Zakat Pendapatan · Blog Tips Kerjaya - You're The Only One I've Told

Pengiraan Kalkulator Zakat Pendapatan Selangor Online - You're The Only One I've Told

Pengiraan Zakat Pendapatan 2024 Cara Bayar Jadual Kiraan - You're The Only One I've Told

cara pengiraan zakat pendapatan selangor - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan Di Selangor : Zakat - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) - You're The Only One I've Told

Fahami perbezaan cara pengiraan zakat ASB di Selangor dan website ASNB - You're The Only One I've Told

Cara Kira Zakat Pendapatan - You're The Only One I've Told

Cara Mohon RM500 Bantuan Zakat Selangor Peduli Secara Online Untuk - You're The Only One I've Told

cara pengiraan zakat pendapatan selangor - You're The Only One I've Told

Jangan Lupa Bayar Zakat Pendapatan Tahun 2020. Ini Cara Kiraannya Yang - You're The Only One I've Told

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan - You're The Only One I've Told