Remember that time you were about to board a plane to Italy, a wave of excitement washing over you as you imagined strolling through cobbled streets and indulging in delicious pasta? But then, panic struck. You needed euros, and you completely forgot to exchange currency before heading to the airport.

We’ve all been there. Planning a trip abroad involves a whirlwind of to-dos – booking flights, finding the perfect Airbnb, curating your must-try food list – it’s easy to overlook the nitty-gritty, like exchanging currency. But trust me, figuring out your currency situation beforehand can save you from stressful last-minute scrambles and potentially unfavorable exchange rates at the airport.

Luckily, getting your hands on foreign currency isn’t the headache it used to be. Gone are the days of frantically searching for the best exchange bureau at the airport, only to be met with sky-high fees. These days, you have options, with banks being a reliable and often cost-effective solution for exchanging currency before your trip.

But with so many banks out there, how do you know which one to choose? What even are the benefits of going through a bank in the first place? And are there any pitfalls you need to watch out for? Don’t worry – we’re about to demystify the world of exchanging currency at banks. Consider this your comprehensive guide to navigating the process with confidence (and scoring those favorable exchange rates).

Let’s dive in!

Advantages and Disadvantages of Exchanging Currency at Banks

| Advantages | Disadvantages |

|---|---|

| Generally offer better exchange rates compared to airports and currency exchange bureaus. | May require you to be an existing customer of the bank. |

| Offer a secure and reliable way to exchange currency. | May have limited availability of certain currencies. |

| Can order currency in advance, ensuring you have the cash you need before your trip. | May have fees associated with currency exchange. |

Best Practices for Exchanging Currency at Banks

Ready to exchange your currency like a pro? Keep these tips in mind:

- Plan Ahead: Don’t wait until the last minute! Start researching and comparing exchange rates at different banks at least a few weeks before your departure date.

- Check for Fees: While banks generally offer competitive exchange rates, they may charge fees for currency exchange services. Inquire about any potential fees beforehand so you’re not caught off guard.

- Consider Ordering in Advance: If you need a specific currency or a larger amount, consider ordering it from your bank in advance to ensure availability.

- Compare Exchange Rates: Don’t settle for the first rate you see! Compare rates from different banks and online currency converters to find the most favorable option.

- Ask About leftover Currency Buyback Programs: Some banks may offer buyback programs where they repurchase your leftover foreign currency at a reasonable rate after your trip.

Common Questions About Exchanging Currency at Banks

Still have some lingering questions about the whole currency exchange thing? You’re not alone! Here are some frequently asked questions (and their answers!) to help clear up any confusion:

- Do I need to be an existing customer to exchange currency at a bank? While some banks may require you to be an existing customer, others may offer currency exchange services to non-customers as well. It’s best to check with the specific bank beforehand.

- How much currency can I exchange at once? Banks may have limits on the amount of currency you can exchange at once, especially for less common currencies.

- What documents do I need to bring with me to exchange currency? Generally, you’ll need to bring a valid government-issued photo ID, such as a driver's license or passport.

- When is the best time to exchange currency? Exchange rates constantly fluctuate, so there’s no single “best” time. However, it’s generally a good idea to start monitoring rates a few weeks before your trip and exchange when you find a favorable rate.

Exchanging currency at a bank can be a convenient and cost-effective way to prepare for your trip abroad. By planning ahead, comparing exchange rates, and understanding the process, you can navigate the world of currency exchange with ease. Bon voyage!

Cara semak insuran motosikal a vital check before you ride

Unleash your inner artist how to draw easy start for graffiti

Unleash power gmc sierra 3500 hd towing capacity explained

The Cuban Government announces an 'exchange scheme' to sell foreign - You're The Only One I've Told

banks that sell foreign currency - You're The Only One I've Told

Currency Exchange South Bank at Eldora Brinkley blog - You're The Only One I've Told

banks that sell foreign currency - You're The Only One I've Told

CBN to Launch Stablecoin February 27 - You're The Only One I've Told

Urban exploration fashion photo with elizabeth banks vibe on Craiyon - You're The Only One I've Told

banks that sell foreign currency - You're The Only One I've Told

Which banks exchange foreign currency into US dollars? - You're The Only One I've Told

When to Sell Foreign Currency - You're The Only One I've Told

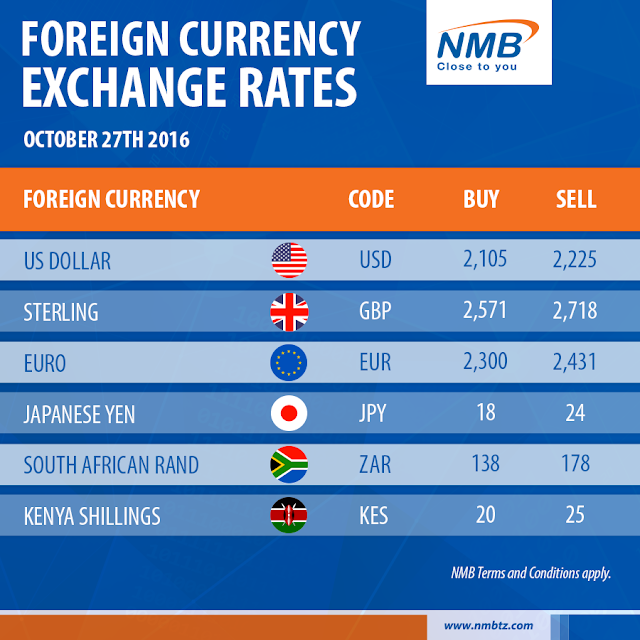

Bank of tanzania foreign currency exchange rates and with it online - You're The Only One I've Told

4 Australian Banks That Still Have Foreign Currency Exchange Services - You're The Only One I've Told

Understanding How Central Banks Manage Foreign Exchange Reserves - You're The Only One I've Told

Sell Your Foreign Currency for NZD - You're The Only One I've Told

Foreign currency exchange rates. Bank Information board with different - You're The Only One I've Told

Outer Banks Beach Fire - You're The Only One I've Told