Are you approaching 65 or already enrolled in Medicare? Understanding the intricacies of Medicare Part B pricing is crucial for managing your healthcare budget. This comprehensive guide will walk you through everything you need to know about Medicare Part B expenses, from the standard premium to potential out-of-pocket costs.

Medicare Part B covers essential medical services like doctor visits, outpatient care, preventive services, and some medical equipment. Unlike Part A, which covers hospital stays, Part B requires a monthly premium. The Medicare Part B premium is an important factor to consider when planning your retirement finances. Knowing the factors that influence these expenses empowers you to make informed decisions about your healthcare coverage.

The history of Medicare Part B dates back to 1965 when the Medicare program was established. Part B was designed to address the increasing costs of physician and outpatient services. Over time, the coverage and cost-sharing structure of Part B have evolved to meet the changing needs of beneficiaries. Understanding the evolution of Medicare Part B costs provides context for the current system.

The significance of understanding Medicare Part B cost lies in its direct impact on your personal finances. These expenses can significantly affect your monthly budget and require careful planning. Ignoring or underestimating these costs can lead to unexpected financial strain. Therefore, being proactive and informed about Medicare Part B expenses is crucial for financial well-being during retirement.

One of the main issues surrounding Medicare Part B premiums is their affordability. As healthcare costs rise, so do Part B premiums. This poses a challenge for many beneficiaries, particularly those living on fixed incomes. Addressing the affordability of Medicare Part B expenses is an ongoing concern for policymakers and advocates.

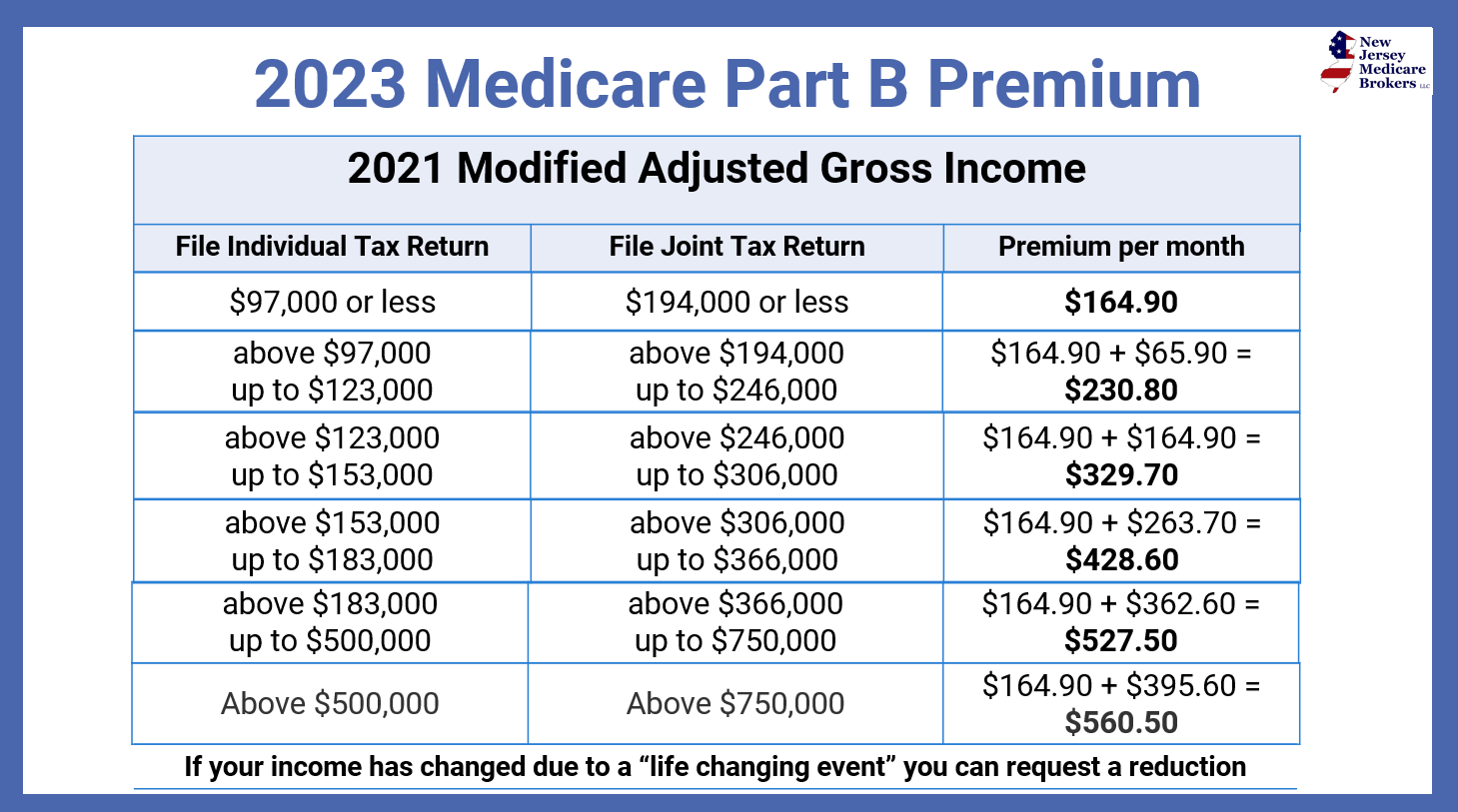

The standard Medicare Part B premium is set annually. However, your actual premium may be higher based on your income. This is known as the Income-Related Monthly Adjustment Amount (IRMAA). Additionally, there's an annual deductible that you must pay before Medicare begins covering a percentage of your Part B expenses. Understanding these cost components is key to accurate budgeting.

One benefit of understanding Medicare Part B costs is the ability to budget effectively. By knowing your expected premium and deductible, you can allocate funds appropriately and avoid financial surprises.

Another benefit is the ability to explore cost-saving strategies. For example, you may be eligible for programs that help lower your Part B premiums. Understanding your options allows you to maximize your healthcare benefits while minimizing costs.

A third benefit is the ability to make informed decisions about supplemental insurance. Medigap policies can help cover some of the out-of-pocket costs associated with Part B, such as copayments and coinsurance. Understanding your Part B expenses will help you choose the right Medigap policy to meet your needs.

Advantages and Disadvantages of Medicare Part B

| Advantages | Disadvantages |

|---|---|

| Covers a wide range of medically necessary services | Monthly premium cost |

| Provides access to preventive care | Annual deductible |

| Helps manage chronic conditions | Coinsurance and copayments for most services |

Best Practices for Managing Medicare Part B Costs:

1. Understand your coverage and benefits.

2. Budget for your premiums and deductibles.

3. Explore cost-saving programs.

4. Consider supplemental insurance.

5. Review your coverage annually.

Frequently Asked Questions:

1. How much is the Medicare Part B premium? (Answer: Varies based on income)

2. What is the Part B deductible? (Answer: Varies annually)

3. What services does Part B cover? (Answer: Doctor visits, outpatient care, etc.)

4. How do I enroll in Part B? (Answer: Through Social Security)

5. What is IRMAA? (Answer: Income-Related Monthly Adjustment Amount)

6. What is a Medigap policy? (Answer: Supplemental insurance)

7. How can I save money on Part B costs? (Answer: Explore cost-saving programs)

8. When can I change my Part B coverage? (Answer: During the Annual Enrollment Period)

Tips and tricks: Explore resources like the official Medicare website and publications for up-to-date information on Medicare Part B costs and coverage.

In conclusion, understanding Medicare Part B costs is an essential aspect of financial planning for retirement. By being proactive and informed, you can navigate the complexities of Medicare Part B expenses, budget effectively, and ensure access to the necessary medical services. This guide has provided a comprehensive overview of Medicare Part B premiums, deductibles, and coverage. Remember to utilize the resources available to you, stay updated on changes to Medicare Part B, and make informed decisions to secure your healthcare future. Taking the time to understand your options and plan accordingly will empower you to manage your healthcare costs and enjoy a financially secure retirement. Don't hesitate to seek guidance from Medicare experts or your local Social Security office for personalized assistance.

Unlocking clarity and consistency your guide to effective rubrics for grading papers

Unlocking ethereal commerce your guide to the tiktok seller center app for pc

Navigating uncertainty understanding the borderline personality disorder test dsm 5

What Will Medicare Part B Cost In 2024 - You're The Only One I've Told

medicare part b cost - You're The Only One I've Told

What Does Medicare Cost Me in 2022 - You're The Only One I've Told

2024 Medicare Part B Deductible Amount - You're The Only One I've Told

2024 Cost For Medicare Part B - You're The Only One I've Told

medicare part b cost - You're The Only One I've Told

How Much Does Medicare Part B Cost In 2024 - You're The Only One I've Told

2024 Irmaa Brackets For Medicare Premiums 2024 - You're The Only One I've Told

Irmaa 2024 Brackets And Premiums Chart 2024 - You're The Only One I've Told

Medicare Announces 2023 Medicare Cost - You're The Only One I've Told

How Much Does Medicare Part B Cost In 2024 - You're The Only One I've Told

Fica And Medicare Rates 2024 - You're The Only One I've Told

What Will Medicare Cost Me in 2023 - You're The Only One I've Told

Medicare Part B Cost Per Month 2024 Chart - You're The Only One I've Told

What Is Medicare Part B Cost For 2024 - You're The Only One I've Told