Ever lie awake calculating how much money you *need*? Not just for rent and ramen, but for that dream vacation, a down payment, early retirement – the whole nine yards? Determining your desired annual income isn't just about numbers; it's about crafting a life you genuinely want. It's about understanding your needs, ambitions, and the financial landscape you're navigating.

The question of “what should my annual income be?” is a complex algorithm, factoring in location, lifestyle, career path, and personal ambitions. There’s no one-size-fits-all answer, and your ideal earnings will likely evolve throughout your life. This exploration dives deep into the elements that shape your target income, offering actionable insights to help you not just survive, but thrive.

Historically, income expectations were often shaped by family tradition, societal norms, and readily available jobs. Today, the digital age has disrupted these conventions. The gig economy, remote work, and entrepreneurial opportunities have broadened the income spectrum, giving individuals more control over their earning potential. This shift, while empowering, necessitates a deeper understanding of personal finance and strategic career planning.

Understanding your target income is crucial for financial stability and achieving life goals. It enables effective budgeting, informs career choices, and motivates you to pursue opportunities for growth. Without a clear understanding of your required yearly earnings, financial planning becomes a shot in the dark, making it difficult to save, invest, and build a secure future.

The fundamental issue regarding yearly income targets is the disconnect between aspirations and realistic expectations. Many individuals anchor their desired salary on societal pressures or lifestyle comparisons without considering the practical steps required to achieve that level of income. Bridging this gap requires honest self-assessment, market research, and a willingness to adapt and evolve your career trajectory.

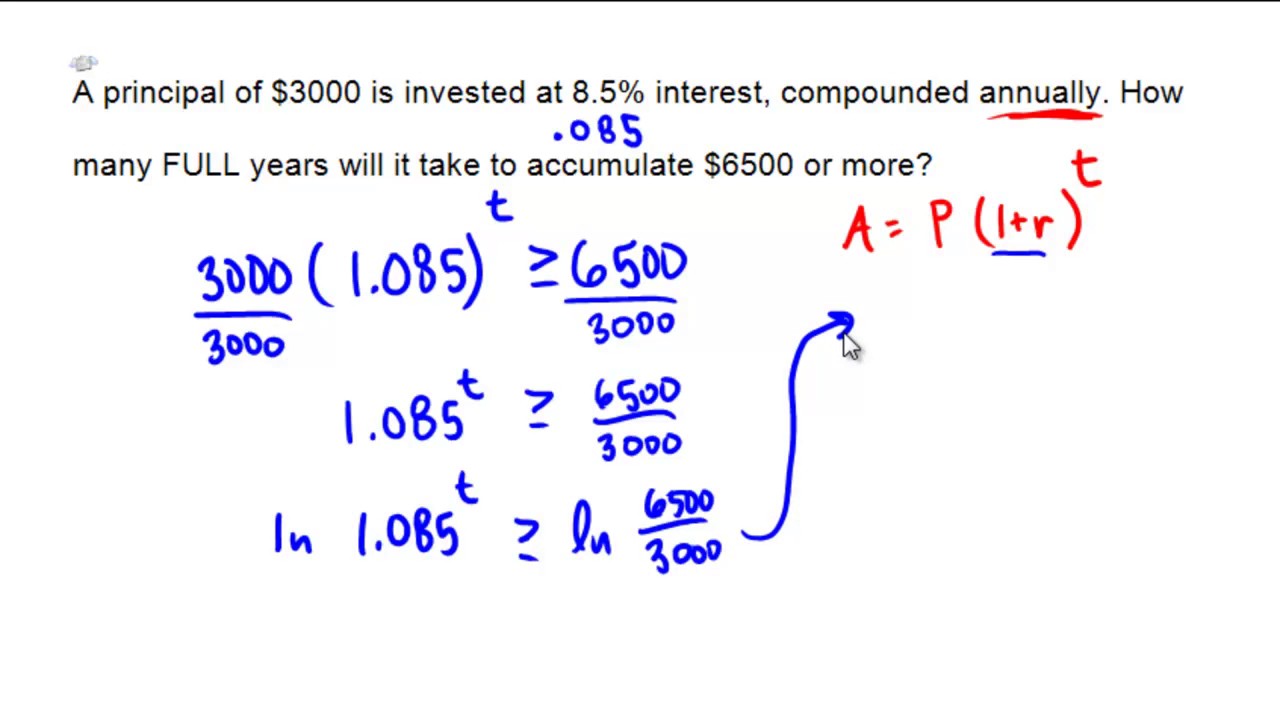

Calculating your ideal annual income isn’t just about adding up expenses. It’s a dynamic process, encompassing short-term needs and long-term goals. Consider your current cost of living, future plans (like buying a house or starting a family), debt management, and investment aspirations. For instance, a comfortable life in a bustling metropolis demands a higher income compared to a smaller town, impacting your desired annual salary.

One benefit of a well-defined income target is empowered financial planning. Knowing your required earnings enables you to create a realistic budget, allocate funds for savings and investments, and track your progress toward financial security.

Another advantage is focused career development. Understanding your desired income clarifies your career path. It motivates you to seek promotions, acquire new skills, or explore alternative income streams aligned with your financial goals.

Finally, a clear income goal fuels personal growth. Striving for a specific earning level pushes you beyond your comfort zone, encourages continuous learning, and fosters a sense of accomplishment as you achieve milestones.

Creating an action plan to achieve your target annual salary involves setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound). Research industry salary trends, identify skill gaps, and develop a plan to acquire necessary qualifications. Networking, professional development, and seeking mentorship can significantly enhance your earning potential.

Advantages and Disadvantages of Focusing on Annual Income

| Advantages | Disadvantages |

|---|---|

| Financial clarity and planning | Potential for overemphasis on money |

| Focused career development | Risk of neglecting work-life balance |

| Motivation for personal growth | Possible dissatisfaction if goals are unrealistic |

Best practices for managing your target income include regular reviews and adjustments, aligning your career path with your income goals, continuously upgrading your skills, networking strategically, and seeking expert financial advice.

Frequently Asked Questions: What factors influence income potential? How do I negotiate a higher salary? How can I supplement my current income? What are the best resources for salary research? How can I improve my financial literacy? What are some common career paths for high earners? How do I manage my finances effectively? What are some smart investment strategies?

Tips and tricks for achieving your target income: Leverage online resources for salary data, build a strong professional network, negotiate assertively, invest in your skills, explore side hustles, and practice disciplined financial management.

Understanding your ideal annual income is not just about desiring a bigger paycheck; it’s about designing a life that aligns with your values and aspirations. By defining your target income, crafting a strategic action plan, and consistently adapting to the evolving economic landscape, you empower yourself to take control of your financial future. This journey requires ongoing self-assessment, informed decision-making, and a commitment to continuous growth. Embrace the challenge, and you'll be well on your way to not just meeting, but exceeding your financial goals, unlocking a future of financial security and personal fulfillment. This allows you to not just dream about the life you want but to build it, brick by financial brick.

Unleash your inner darkness exploring traditional demon tattoo ideas

The mouthwatering story behind the buffalo wings n things logo

Remembering lives nelson funeral home obituaries

Aggregate more than 130 sketch artist salary 2019 latest - You're The Only One I've Told

Compound Interest Formula With Monthly Deposits - You're The Only One I've Told

how much do farmers make annually - You're The Only One I've Told

How Much Money Does GMA Host TJ Holmes Make Annually - You're The Only One I've Told

How To Find Interest Rate Needed - You're The Only One I've Told

How Much Interest Does 1 5 Million Make at Jane Griffin blog - You're The Only One I've Told

A man wants to make 14 nominal interest compounded semiannually on a - You're The Only One I've Told

how much should i make annually - You're The Only One I've Told

How Much Should YOU Save Per Year Examples and Charts - You're The Only One I've Told

How Much Money Do Colleges Make From Sports 2024 - You're The Only One I've Told

Find the compound interest on rupees 2000 for 2 years at 15per annum - You're The Only One I've Told

At A Certain Rate Of Interest Compounded Annually A Sum 59 OFF - You're The Only One I've Told

Solved Mr Racusa deposit P4000 into account paying 6 annual - You're The Only One I've Told

30 an Hour is How Much a Year - You're The Only One I've Told

Solved Money is worth 12 compounded semi - You're The Only One I've Told