Navigating the labyrinthine world of healthcare costs can feel like tumbling down a rabbit hole. For those approaching 65 or already enrolled in Medicare, understanding Part B medical insurance expenses is crucial. But where to begin? This comprehensive guide aims to demystify Medicare Part B medical insurance premiums and provide you with the knowledge you need to make informed decisions.

Medicare Part B, often called medical insurance, covers essential medical services like doctor visits, outpatient care, preventive services, and some medical equipment. Unlike Part A (hospital insurance), Part B isn't free. It comes with a monthly premium, an annual deductible, and cost-sharing in the form of coinsurance. Grasping these expenditures is essential for effective budgeting and avoiding unexpected medical bills.

The history of Medicare Part B dates back to 1965, when it was signed into law alongside Part A. It aimed to provide senior citizens and individuals with disabilities access to necessary medical services beyond hospitalization. Over the years, Medicare Part B has evolved to cover a broader range of services, reflecting advances in medical technology and changing healthcare needs. It’s become a cornerstone of healthcare security for millions.

The main issues surrounding Medicare Part B medical insurance cost revolve around affordability and coverage gaps. Rising healthcare costs have led to premium increases, impacting beneficiaries' budgets. Furthermore, the standard Part B plan doesn't cover everything. Dental care, vision, and hearing aids are typically not covered, creating potential out-of-pocket expenses. Understanding these limitations is vital for informed financial planning.

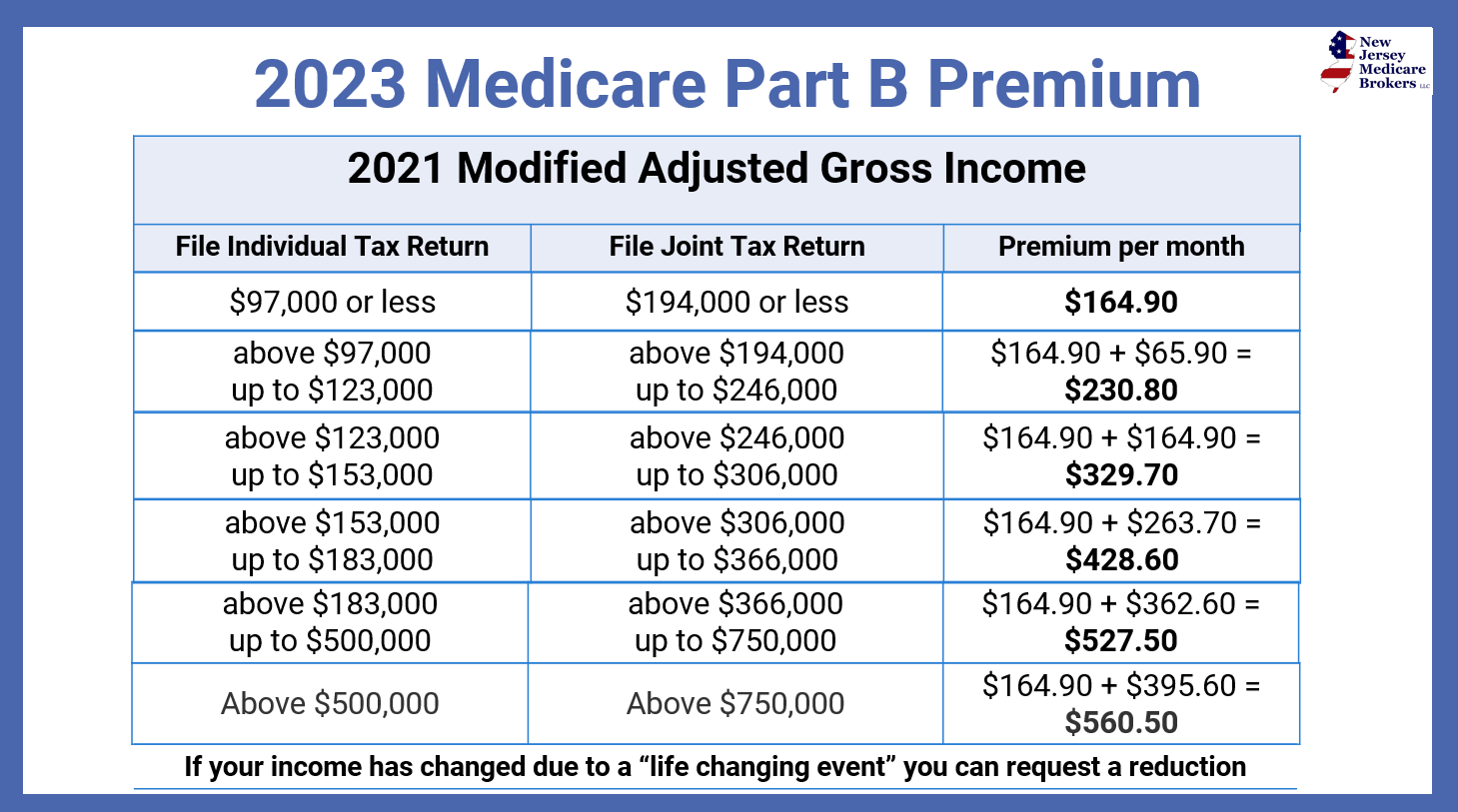

So, what exactly determines your Medicare Part B premium? Several factors come into play. Your income plays a significant role. Higher earners pay higher premiums through what’s known as an Income-Related Monthly Adjustment Amount (IRMAA). The standard monthly premium is set annually, and adjustments are based on various economic factors.

One of the primary benefits of Medicare Part B is access to a wide range of medically necessary services. From routine checkups with your doctor to more specialized outpatient procedures, Part B provides crucial coverage. For example, if you require an MRI, Part B would cover a significant portion of the cost, leaving you responsible for only the coinsurance.

Another benefit is access to preventive services. Medicare Part B emphasizes preventive care, covering services like annual wellness visits, vaccinations, and screenings for certain diseases. These preventive measures can help detect and manage health conditions early on, potentially reducing future medical costs and improving overall health outcomes.

A third advantage is the coverage for durable medical equipment (DME). If you require equipment like a walker, wheelchair, or oxygen tank, Medicare Part B often covers a portion of the cost. This can significantly alleviate the financial burden of acquiring necessary medical equipment.

Advantages and Disadvantages of Medicare Part B

| Advantages | Disadvantages |

|---|---|

| Covers a wide range of medically necessary services | Monthly premium costs |

| Provides access to preventive services | Annual deductible |

| Covers durable medical equipment | Coinsurance payments |

| Offers peace of mind and financial security | Doesn't cover all medical expenses (e.g., dental, vision) |

One crucial tip is to review your Medicare Part B coverage annually. Ensure your current plan meets your needs and explore options like Medigap policies to help fill potential coverage gaps. Stay informed about changes to Medicare Part B rules and regulations by regularly visiting the official Medicare website or consulting with a qualified healthcare professional.

Understanding Medicare Part B medical insurance costs is paramount for effective healthcare planning. From understanding premiums and deductibles to exploring cost-saving strategies, empowering yourself with this knowledge can lead to better financial management and improved health outcomes. Be proactive, stay informed, and take control of your healthcare journey.

The power of filipino poetry on goodness exploring tula tungkol sa kabutihan

Connecting with dr horton your guide to the main office and beyond

Think you know your brands test your mettle with a logo quiz game download

Will you enter the 2024 Medicare Part D Coverage Gap or Donut Hole - You're The Only One I've Told

What Is Cost For Medicare In 2022 - You're The Only One I've Told

Medicare Part G Deductible 2024 - You're The Only One I've Told

How Much Is Medicare Deductible For 2024 - You're The Only One I've Told

2024 Medicare Deductibles And Copayments - You're The Only One I've Told

Medicare Premium Income Limits 2024 Nyc - You're The Only One I've Told

Medicare Premium is Going Down in 2023 Medicare Annual Enrollment - You're The Only One I've Told

What Will Be The Irmaa For 2024 - You're The Only One I've Told