In the heart of Malaysia, where lush rainforests meet bustling cities, lies Pahang, a state steeped in history and tradition. For its Muslim community, fulfilling religious obligations like zakat is a fundamental aspect of life. Zakat, one of the five pillars of Islam, is a form of obligatory charity and a powerful tool for social justice. Understanding how to calculate zakat, particularly zakat on income, is essential for every Muslim in Pahang. This guide will delve into the intricacies of "cara kira zakat pendapatan Pahang" (how to calculate zakat on income in Pahang), providing clarity and guidance.

Imagine a safety net woven from compassion and shared responsibility, where those who have more contribute to uplift those less fortunate. This is the essence of zakat. "Zakat pendapatan" specifically refers to the zakat calculated on one's earnings. In Pahang, as in other Malaysian states, Muslims are obligated to pay zakat on their income if it reaches a certain threshold (nisab).

The history of zakat dates back to the time of Prophet Muhammad (peace be upon him), solidifying its significance in the Islamic faith. Its importance lies not just in purifying one's wealth but also in fostering community development and alleviating poverty. When zakat is paid diligently, it creates a ripple effect, empowering the underprivileged and fostering economic balance within society.

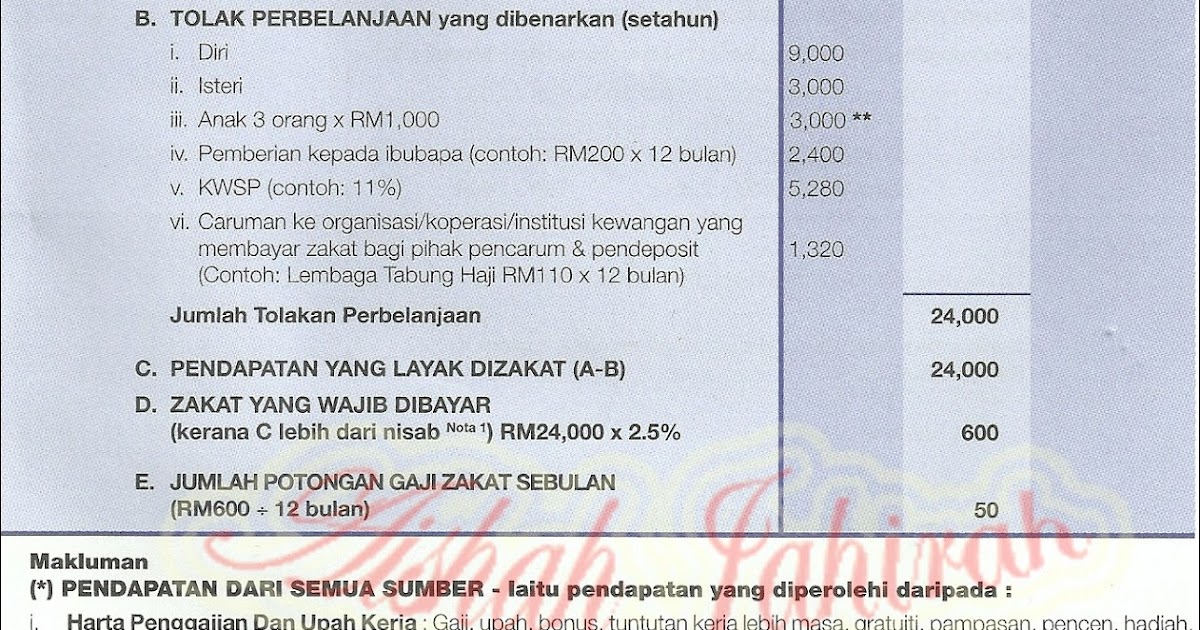

While the concept of zakat is straightforward, the calculation can seem daunting, especially for those unfamiliar with its intricacies. Several factors come into play, such as the type of income, deductions, and the current market value of gold or silver (which determines the nisab). Misunderstandings or lack of awareness surrounding these details often lead to miscalculations.

This is where "cara kira zakat pendapatan Pahang" comes in, providing a clear roadmap for Muslims in Pahang to fulfill their zakat obligations accurately. By understanding the specific guidelines set by the Pahang Islamic Religious Council, individuals can ensure they are paying the correct amount, maximizing the impact of their contribution to the community.

Advantages and Disadvantages of Understanding Zakat Calculation

| Advantages | Disadvantages |

|---|---|

| Fulfilling a religious obligation | May require effort to understand initially |

| Contributing to poverty alleviation | - |

| Promoting social justice | - |

| Purifying wealth | - |

Best Practices for Calculating Zakat on Income in Pahang

While this guide provides a comprehensive overview, seeking information from official sources like the Pahang Islamic Religious Council website or consulting with a knowledgeable religious scholar is always recommended.

Android auto launcher apk pimp your rides infotainment

Unleashing creativity the art of eye catching competition posters contoh poster lomba yang menarik

Revolutionizing bathroom design the rise of three panel shower doors

Cara Kira Kadar Zakat Pendapatan 2022 Yang Perlu Dibayar. Jangan Lupa - You're The Only One I've Told

Cara Kira Kadar Zakat Pendapatan 2020 Yang Perlu Dibayar. Jangan Lupa - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) - You're The Only One I've Told

Panduan Lengkap Zakat Pendapatan di Malaysia 2024 - You're The Only One I've Told

Zakat saham: Cara kira & bayar zakat online - You're The Only One I've Told

cara kira zakat pendapatan pahang - You're The Only One I've Told

Panduan Kira Zakat Perniagaan Dengan Mudah - You're The Only One I've Told

Cara Mudah Kira Zakat Pendapatan - You're The Only One I've Told

Cara Kira Zakat Pendapatan - You're The Only One I've Told

cara kira zakat pendapatan pahang - You're The Only One I've Told

Cara Kira Zakat Simpanan Yang Wajib Anda Tahu » EduBestari - You're The Only One I've Told

Cara Pengiraan Zakat Pendapatan - You're The Only One I've Told

9 Jenis Zakat Harta & Cara Kira Zakat - You're The Only One I've Told

Rupanya Ada 2 Cara Kira Zakat Pendapatan - You're The Only One I've Told

Cara Kira Zakat Emas & Kadar Uruf Emas Setiap Negeri 2024 - You're The Only One I've Told